Uncertainty when it has passed in the market

Open free editor’s words

Roula Khalaf, the gap editor, chooses the stories he likes most during this weekly.

This article is the type of website for our website. Premium authors can sign up here to find information protected from every day of each week. Standard authors can improve in premium here, or check all matters

Good morning. New European Security Fund is to buy EU weapons from EU countries, or from EU countries – or from countries with security agreements and bloc. This says that we do not name in Europe but, as believers in world activities, makes us disillusioned. Send us email and tell us how to feel: Robert.Armstrong @ ft.com.Reiter @ ft.com.

Fed poplock and market response

“Marase liked what it heard from Jay Powell and Federal Open Business doors yesterday. No one made cartheels, but stocks, enjoyed a solid day before the story and difficulty, even when the zeal came to the end of the day. The products of an asset rank fell – one year with three points, so one year. Meetings for celebrations, now? Then? And then? Now?

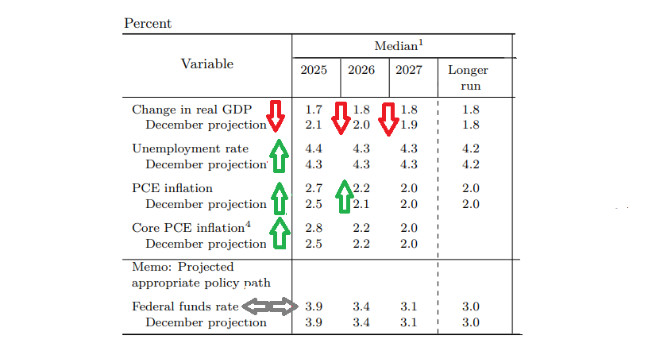

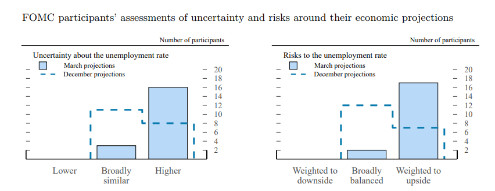

Not really. It is easy to imagine that the world with investors who have listened to what the bank told yesterday and I don’t like a little bit. Its committee increased its vision with a lot, adding its view for a lack of hair, turns on it. Here are the narrative medical digits of feeding, with arrows added by cancellation:

There is a word for this kind of thing, and a bad word: stagfution. It is not that fed is meant to be said to a great deal of sight s, but the expectations enable the wrong way in both sides of the middle bank. And the feed was clear because of this: A great decrease investor, business and customers that are well built in Trump administration, especially systems.

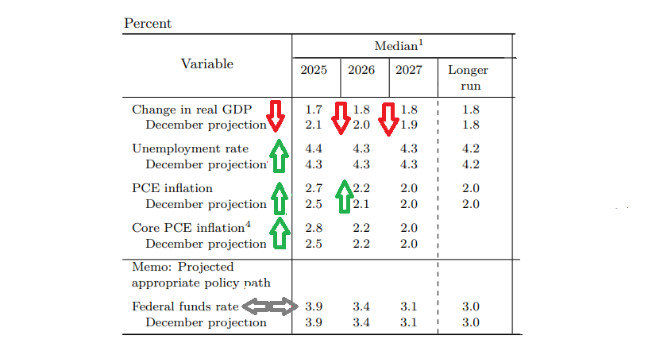

Yes, the idea of a plan to provide “” interested “strategy stayed the same. But that lesson is average, and hides the strategy line. Reduce three high and lowest estimates and “title expectation is nothing. In the Publishing Planning Appendix. Below is a chart of unemployment committee

This is all the lowest. So why is the unusual brother response? There are several opportunities:

-

Those who have fed the message market had already received. The market knew their anxiety, adding dangers to risk in growth and inflation.

-

There was independence that made them understand their teeth at risk set by rates. Powell took a limited sound, emphasizing that it would be appropriate to look at the lowest price of a long-term flow. This is not a central bank looking to fight with the Executive branch.

-

Market, looking forward to finding good months, took plans for unchanged interest, being rejected with all of this.

We leave it to readers to decide their weight among three.

At the end of the qt

Forted Winning Market Yesterday By Being Dedicated Cash Earn $: Refunding Months at $ 5bn. It is not surprising that QT ends; With many steps, we are close to the purpose of fabrication of “aample”, but not a lot, in classmates.

Most of the flowers from the end of the past year gave a qt to end the first half half of the year, perhaps in June. The picture changed from then – minutes from the narrator meeting thought of the ending of the “Seventh in the following months” related to debt “. However, the text-written bushes were recommended in QT-suspicion would begin in May.

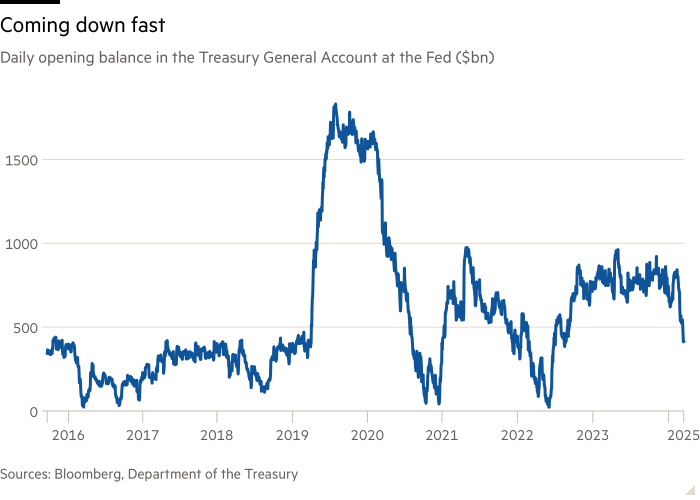

Yesterday, Charui Powell said, slow. It is a variety of message with the details of the January meeting. And such a concern can be justice: the debt massage, or limit of what the US can allow this year’s company, was returned to the beginning of this year, after two years. Until the credit limit is presented or suspended again, the asset is hungry for new debt. On the contrary, it spends its $ 414 fed out.

The clock took off. And with new tax return, the asset should run out of money “in one summer this summer, depending on the brij khurana.” An asset will need to take “unusual steps” from Aflaulting.

Congress will raise on the roofs of debt before occurring – even when there is a problem doing so by doing so. After that, a treasure will need to produce new debts to build its pigs. If that wanted to match qt

As the asset is deducting its money money, that increases the liquid to [banking] The system. But when a treasure build its money money [by issuing more Treasuries]The amount of money from the bank administration returns to a malking report. That pulls from bank management. Qt also assumes enough in the system.

An asset provided new credit at 2022 when QT was completely completely. But at that time there were many sources and sources of water (such as finances in the rear. If Qt and the explosion of new net production may have threatened.

QT drop is the market content. Opportunities that appreciate the added arrow. And, though the QT impact and QT in prison in prison may reduce the end of Qt should reduce in Anathe’s spots.

We are happy to take a walk with her voice. But it is possible to decrease in order to decrease because of stress during what would be summer and financial system. Other Republics are focused on national debt, when many demographs are looking for ways to press the trumpet. The risk of having a limited financial difficulty decides to do what you need to do in a debt ceiling. It is better to risk getting off the table you can afford.

(Reitter)

To read well

Bros.

Uncontrolled podcast

Cannot equal not restricted? Listen to our New Podcast Podcast Podcast 15 miles 15 miles, twice a week. Indicate in the past priority of the text here.

Recommendations

Due diligence – Top stories from the business world. Sign Up Here

Lunch – Your guidance to the old opponents of the Economic Source. Sign Up Here

#Uncertainty #passed #market